The medical insurance trade in the USA, extra generally known as the Well being Upkeep Group (HMO) area, continues to learn on the again of a few components — a well-performing Authorities enterprise being an important one. Different components contributing to the upside embody an growing older US inhabitants, energetic pursuit of a merger and acquisition (M&A) technique and a stable monetary place that permits them to undertake continued know-how investments.

By the Authorities enterprise, the well being insurers devise cost-effective Medicare, Medicaid in addition to Market plans and prolong them throughout a number of US communities. These plans, backed with some superior options within the type of various copays and deductibles, have paved the way in which for quite a few contract wins from state authorities, which in flip bolsters the client base of the well being insurers. Rising membership fetches elevated premiums, which bodes effectively as premiums stay one of the important contributors to revenues of any well being insurer.

Strong demand for Medicare plans, that are primarily meant to serve folks aged 65 or above, is anticipated to proceed within the days forward owing to a quickly rising growing older US inhabitants. Therefore, well being insurers can capitalize on rising serving the growing older inhabitants through a wide selection of Medicare plans. Per the main market and client information supplier Statista, round 16.9% of the American inhabitants was aged 65 years or above in 2020, and the proportion is anticipated to succeed in 22% by 2050.

A potent M&A method is prone to stay energetic within the HMO trade because the well being insurers intend to spice up capabilities, carry diversification advantages, widen buyer base and strengthen their world presence by way of these development initiatives. The trade has been enterprise important investments to maintain tempo with the pattern of digitization being infused throughout each sphere of life. Consequently, the trade gamers have been devising digital healthcare options, which in flip, ease supply of healthcare companies and increase operational efficiencies. The investments would possibly end in escalating prices for well being insurers, however the digital companies proceed to fetch a gentle income base and can drive margins in the long run.

M&A bankers at Morgan Stanley stay optimistic about 2022 rising as a stable yr with respect to M&A offers. The potential to pursue an energetic M&A method or know-how investments highlights the stable monetary place within the type of sufficient money reserves or money technology talents possessed by the HMO trade gamers.

The prevailing situation makes us optimistic relating to constant development within the HMO trade, which ought to bolster the prospects of firms with sound enterprise fundamentals.

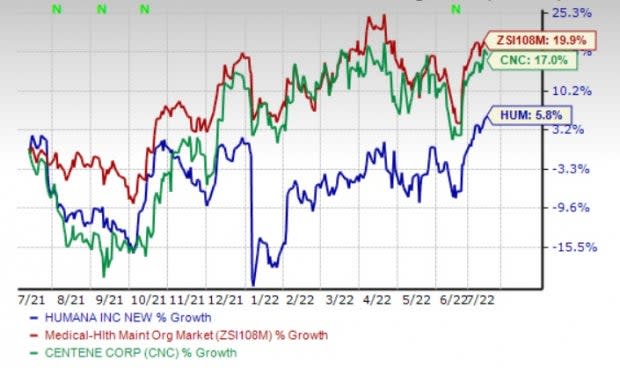

The Zacks Medical-HMO trade, which is housed throughout the broader Zacks Medical sector, has gained 19.9% prior to now yr in opposition to the sector’s decline of 16.9%. The S&P Index misplaced 10.9% in the identical time-frame.

Picture Supply: Zacks Funding Analysis

Towards this backdrop, let’s check out the 2 HMO trade shares Humana Inc. HUM and Centene Company CNC, with market capitalizations of $61.2 billion and $51 billion, respectively. Each shares carry a Zacks Rank #3 (Maintain) at current. You possibly can see the whole listing of in the present day’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Let’s delve deeper into particular parameters to determine which firm is best positioned in the mean time.

Worth Efficiency

Shares of Humana gained 5.8% in a yr in contrast with the trade’s rally of 19.9%. In the meantime, Centene inventory rose 17% in the identical time-frame. Evidently, CNC has the sting over HUM right here.

Picture Supply: Zacks Funding Analysis

Earnings Shock Historical past

A inventory’s earnings shock observe helps buyers get an thought about its efficiency within the earlier quarters.

Humana’s backside line beat estimates in every of the trailing 4 quarters, the typical shock being 5.94%. In the meantime, Centene’s earnings surpassed the mark in two of the trailing 4 quarters and missed twice, the adverse common shock being 0.42%. It’s clear that HUM has a greater studying than CNC right here.

ROE

Return on fairness (ROE) is a profitability measure that signifies how effectively the corporate is using its shareholders’ funds.

Picture Supply: Zacks Funding Analysis

Humana’s ROE of 17.3% exceeds Centene’s ROE of 11.8%. Nevertheless, each the shares have an ROE beneath the trade common of twenty-two.3%.

Valuation

The worth-to-earnings worth is the most effective a number of used for valuing healthcare shares. In contrast with Humana’s ahead 12-month P/E ratio of 18.54, Centene is cheaper, with a studying of 14.61. The HMO trade’s ahead 12-month P/E ratio is 20.35.

Picture Supply: Zacks Funding Analysis

Debt-to-Fairness

The decrease the debt-to-equity ratio, the higher it’s for the corporate because it implies a sound solvency degree. CNC’s leverage ratio of 69.3X betters HUM’s ratio of 84.6X, however the metric for each shares stays larger than the trade common of 57.6X. Subsequently, Centene holds an edge over Humana on this entrance.

Picture Supply: Zacks Funding Analysis

Strong 2022 Prospect

The Zacks Consensus Estimate for HUM’s 2022 earnings signifies a year-over-year enchancment of 19.4%, whereas the identical for CNC suggests 9.5% year-over-year development this yr. Evidently, Humana has the sting over Centene right here.

Dividend Historical past

Humana has been a daily dividend-paying firm, and its dividend yield stands at 0.7%. In the meantime, Centene doesn’t resort to dividend funds. This spherical belongs to HUM.

Membership Development

Rising membership normally boosts the numerous top-line contributor of an HMO firm – premiums. HUM ought to be involved on this entrance, because the well being insurer needed to trim its 2022 Medicare membership development steerage by roughly 50%. In the meantime, CNC is witnessing spectacular development in its Medicare enterprise and expects to maintain the pattern within the days forward.

Premium Revenues

Undoubtedly, one of many main metrics that increase a well being insurer’s revenues is its premiums. Premiums reported by Humana got here in at $22.7 billion within the first quarter of 2022, whereas the metric for Centene totaled $31.9 billion in the identical time-frame. Thus, CNC wins this spherical.

Conclusion

Our comparative evaluation reveals that Humana is better-placed than Centene with respect to the earnings shock historical past, ROE, sturdy 2022 prospect and dividend historical past. In the meantime, CNC scores larger by way of worth efficiency, valuation, leverage ratio, premium revenues and membership development. With the size tilted barely towards Centene, the inventory seems to be higher poised.

Need the newest suggestions from Zacks Funding Analysis? Right now, you possibly can obtain 7 Finest Shares for the Subsequent 30 Days. Click on to get this free report

Humana Inc. (HUM) : Free Inventory Evaluation Report

Centene Company (CNC) : Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis